Mastering Forex Portfolio Management: Tips for Success

Forex portfolio management is a crucial aspect of successful trading in the foreign exchange market. It involves carefully managing your investments to achieve maximum returns while minimizing risks. In this article, we will discuss some essential tips for mastering forex portfolio management and achieving success in the forex market.

Understanding Forex Portfolio Management

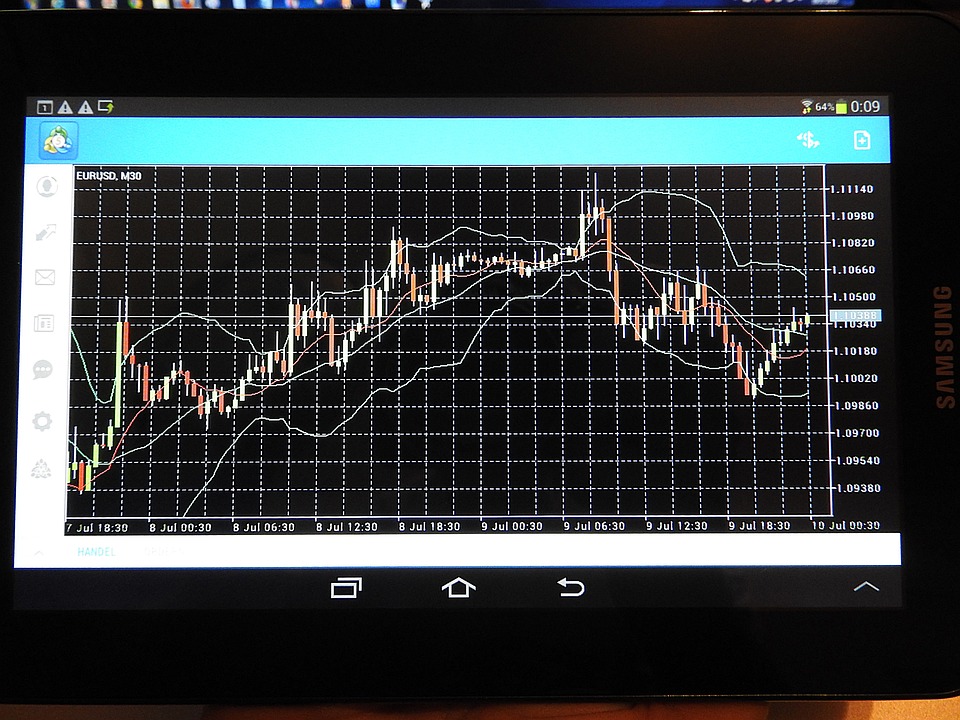

Forex portfolio management is the process of strategically allocating and managing your investments in various currency pairs to achieve your financial goals. It involves balancing risk and reward, diversifying your investments, and continuously monitoring and adjusting your portfolio based on market conditions.

Successful forex portfolio management requires a deep understanding of the forex market, economic indicators, technical analysis, and risk management principles. It also involves developing a trading strategy that aligns with your financial goals and risk tolerance.

Essential Tips for Success

Diversify Your Investments

Diversification is key to reducing risk in your forex portfolio. By investing in a variety of currency pairs, you can spread out your risk and minimize the impact of any single trade on your overall portfolio. Diversification can help protect your investments from unexpected market movements and increase the stability of your portfolio over time.

Set Realistic Goals

It is essential to set realistic and achievable goals for your forex portfolio. Consider your risk tolerance, investment timeline, and financial objectives when setting your goals. Setting realistic goals will help you stay focused and disciplined in your trading, leading to better long-term results.

Implement Risk Management Strategies

Risk management is a critical component of successful forex portfolio management. Implementing risk management strategies such as stop-loss orders, position sizing, and proper leverage can help protect your investments from significant losses and preserve your capital during market downturns.

Stay Informed and Educated

The forex market is constantly evolving, and staying informed about market trends, economic events, and geopolitical developments is essential for successful portfolio management. Continuously educate yourself about the forex market, learn new trading strategies, and stay up to date with the latest market news to make informed trading decisions.

Regularly Review and Adjust Your Portfolio

Regularly reviewing and adjusting your forex portfolio is crucial for adapting to changing market conditions and optimizing your investment performance. Monitor your trades, evaluate your trading strategy, and make necessary adjustments to your portfolio to stay on track towards your financial goals.

FAQs

What is forex portfolio management?

Forex portfolio management involves strategically allocating and managing investments in various currency pairs to achieve financial goals while minimizing risks.

Why is diversification important in forex portfolio management?

Diversification helps reduce risk by spreading investments across different currency pairs, minimizing the impact of any single trade on the overall portfolio.

How can risk management strategies benefit forex portfolio management?

Risk management strategies such as stop-loss orders and proper leverage can help protect investments from significant losses and preserve capital during market downturns.

Why is staying informed and educated crucial for successful forex portfolio management?

Staying informed about market trends and economic events is essential for making informed trading decisions and adapting to changing market conditions.

Why should forex portfolios be regularly reviewed and adjusted?

Regularly reviewing and adjusting portfolios helps optimize investment performance and adapt to evolving market conditions, ensuring alignment with financial goals.

For more detailed insights on mastering forex portfolio management, check out this resource.